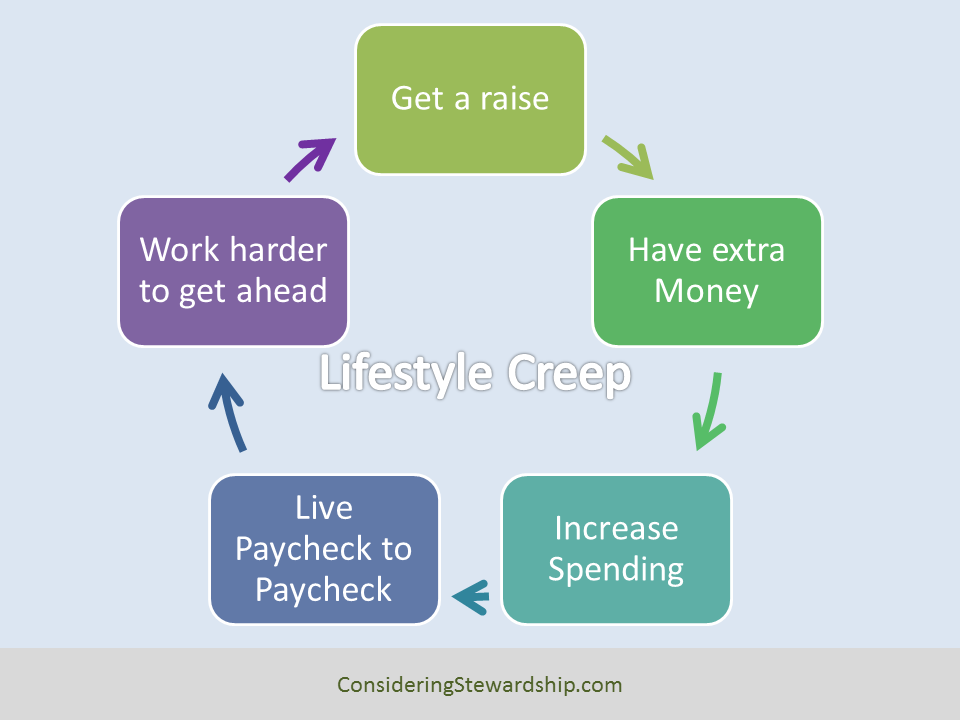

Lifestyle Creep

What is Lifestyle Creep?

Lifestyle creep is defined by investopedia as:

Lifestyle creep is defined by investopedia as:

A situation where people’s lifestyle or standard of living improves as their discretionary income rises either through an increase in income or decrease in costs.

This simply means spending more money just because you can. For most of us that comes when we get a raise. We can spend more now; we can buy the little things we have always wanted.

My wife and I have noticed that we spend more on things that we didn’t “need” before. It happens to us all, when we are forced to do so we can live on very little and be quite satisfied, remember college? What is it that happens to us that causes us to spend more later down the line? Our lifestyle creeps.

Is lifestyle creep bad?

If lifestyle creep isn’t intentional then I would argue that, yes, it is bad, because it means you are not in control of yourself and your finances. If you and your family have intentionally made the decision to improve your lifestyle or increase your budget for the right reasons, then great. I am not arguing that everyone should be living like broke college students. Most of us paid our dues, and if we have kids now they would love ramen noodles and mac and cheese for every meal it would not be healthy for anyone.

If we aren’t paying attention and lifestyle creep happens then we are not being good stewards of our money. We are just allowing it to flow whatever direction we feel like at the time. Not being careful and intentional with the money entrusted to you can cost you down the line by reducing the amount of money you can give or save.

The more expansive your lifestyle is, the harder you will be hit by financial crisis if and when it comes. If you live more simply, by definition you require less money each month. If you lose your job or have an emergency expense you will have more money to be able to handle it.

How to Prevent Lifestyle Creep.

The best way I have found to prevent lifestyle creep is to automate your finances as much as possible. Direct deposit is a huge benefit for this. My wife and I know exactly how much we have budgeted and that is all that goes into our regular checking account from my paycheck. This is easily explained with an example.

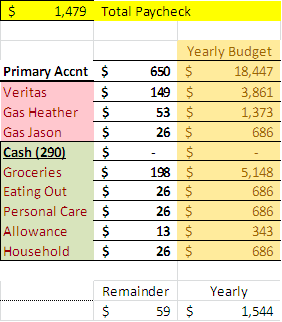

This is what our actual budget looks like but I have changed the numbers a little. The $1479 would be my total paycheck. Only $650 is deposited into our primary account (The one we have easy access to). The remainder is directly deposited into a secondary account where it then transferred to other savings plans and pays our monthly bills.

The pink accounts are non-cash spending. Veritas is our church and that is automatically sent by the bank every two weeks with every paycheck

The green line items are our cash spending. We actually pull cash and put them into envelopes marked as groceries, eating out etc… There is a whole set of reasons why we settled on cash spending.

It leaves us with a little ($59) left over every two weeks. When I get my next paycheck I pull what is left over from that $59 dollars out and into a savings account. Every two weeks we are starting from scratch and keeping to the same budget.

This way even when I get my yearly raise we don’t see it in our primary spending account. Our budget changes when we decide it needs to, not simply because there is more to spend. This worked out very well when I got an unexpected bonus from work, we didn’t say “Hey, let’s spend it” In fact I forgot to tell my wife until a few months later that I got a bonus at all. (oops)

Improving your lifestyle is not a bad thing; if I lived like I did in college with my kids CPS may show up at my door. But if we are to be good stewards of our finances we should be in control. And we should be constantly looking out for things getting out of hand.

About the author