Snagshout review

Snagshout is a social deals website that creates a connection between shoppers and brand owners.

Snagshout is a social deals website that creates a connection between shoppers and brand owners.

Snagshout offers products at discount prices in exchange for reviews of the products. I had never tried to use this type of service before so I naturally wanted to give it a shot. The big bonus was most of the deals you can snag are through amazon so I felt safe in dealing with them. I snagged a pack of 6 micro USB connectors because we lose and break those things all the time. Normally they are 12.99, but with the supplied promo code they were 1.99 and with my Amazon Prime account the shipping was free and two days.

Snagshout made the whole process easy by including buttons directly to he product and the a button to send me to the review page once my purchase was complete. I wrote the review after I had time to test out the cables (which worked fine, it was a simple product) and it was approved by Amazon in moments. For some reason Snagshout had some trouble finding my review and after a three days I simply pasted the URL for my review into their handy field and it was approved by Snagshout a few hours later. The process was clean and easy.

My wife picked up an immersion blender for $10 and had no trouble with her review approval, so perhaps I did something wrong. Let me know if you have issues if you check it out.

The products Snagshout offers seem to rotate in and out, I am seeing items now I didn’t see before and some items I thought to come back and claim are out so it would be good to check regularly and see what they have available.

This post contains affiliate links.

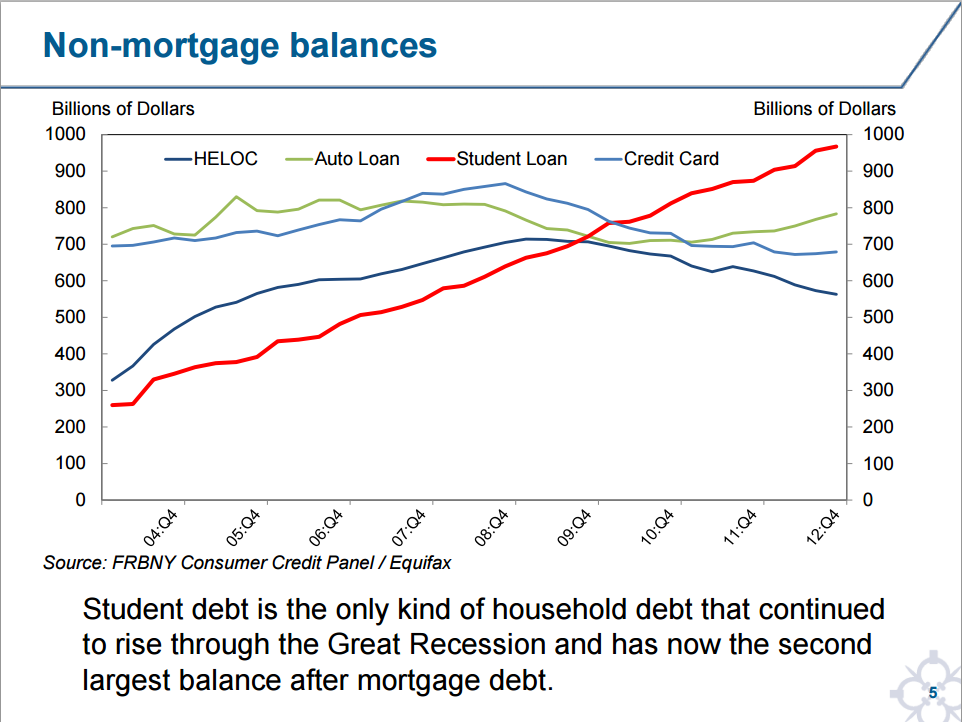

Student Loan Debt Continues to Rise

A new report by the New York Fed shows that while many of us were paying off debt during the great recession. Student loan debt was the only category to continue to rise.

We have a group of young people who are not only going into debt up to their eyeballs and demanding someone else pay for it. They are also being forced to pay money to the richest age group in America through taxation.

Something is going to give here and I am not quite sure what it is, but I don’t think it is going to be pretty.

Source: http://www.newyorkfed.org/newsevents/mediaadvisory/2013/Lee022813.pdf

Fund retirement or pay off mortgage.

I get this question a lot in my classes. It is better to pay off a mortgage or fund retirement? This is one of those decisions that depends on what one means by better, which sounds like a cop out but really it isn’t.

I get this question a lot in my classes. It is better to pay off a mortgage or fund retirement? This is one of those decisions that depends on what one means by better, which sounds like a cop out but really it isn’t.

The debate boils down to this…

If your interest mortgage interest rate is 4% and you pay extra on your mortgage you are making 4%. If you can make more than 4% investing you will make more money investing.

But that does over simplify things a bit. And doesn’t answer the question “is it best for you”?”

Mathematically, you can make more money by not paying off a mortgage if your interest rate is low enough and you have a good investment strategy, however that may not be what you mean by this decision. Some people would be served better by the freedom a free and clear house can bring. Maybe you want to start a business or change careers or go into the mission field. Having a free and clear house could make that much easier.

Folks like Dave Ramsey are big proponents of paying off your mortgage, it is one if his big steps in accomplishing financial peace. And I think I would argue that it is probably best for most people, simply because most people aren’t good at managing their money.

Thoughts from around the web…

http://twocents.lifehacker.com/money-advice-the-experts-don-t-agree-on-paying-off-you-1607494999

Pay Off Mortgage Early vs. Save More For Retirement? Digging Deep Into The Details

Image by stevensnodgrass

Money dangers in your 30s

I have posted previously about how to screw up your finances in your 20s. And now that I am half way through my 30’s I can see a few money dangers that I would like to warn you about. My wife and I started to notice some things in how we looked at money and maybe this isn’t about how old you are, but how long you have been taken personal finance seriously. I feel like we are hitting a point of frugal fatigue. I have been frugal for a long time now, most of my adult life actually. And there are days I am getting quite tired of it.

I have posted previously about how to screw up your finances in your 20s. And now that I am half way through my 30’s I can see a few money dangers that I would like to warn you about. My wife and I started to notice some things in how we looked at money and maybe this isn’t about how old you are, but how long you have been taken personal finance seriously. I feel like we are hitting a point of frugal fatigue. I have been frugal for a long time now, most of my adult life actually. And there are days I am getting quite tired of it.

Here are some dangers to look out for…

- Spoiling your child – We were determined not to do this, in fact for the first 6-8 years we really didn’t buy much for our girls. We were very blessed by friends who gave us a lot of toys and grand parents that did most of the new buying. Recently, however we are finding that our girls have A LOT of stuff. We even started storing bins of different types of toys in the garage and rotating them out so they would play with different things. Kids don’t need as much as they want. It is easy to try to give them more and more stuff, but they want your time and attention more.

- Spoiling yourself – This one is actually harder money dangers for me than spoiling the kids, at least right now. We are still struggling with the right decision for our house. It is nice to look at all the big new homes that we could “afford”, but are obviously able to live in something smaller. Our (my) pride is pushing me to buy a bigger house than we need. It is easy as you are coming into the prime of your career to want to buy more and more but this is the time to stay the course and live simply to help those in a world of need.

- Ignoring Insurance needs – Look, no one likes to talk about this, but if you have a growing family you need to look at insurance. Life insurance is meant to take care of your family if something happens to you. Do you really want your spouse struggling to keep your home and your family together? You should really chat with an insurance professional and decide what is best for your family.

- Ignoring a will, POA and survivor checklist – along those same lines, if you have a family and don’t have a will, “shame on you”. You don’t want your spouse struggling over decisions surrounding your death, or arguing with your family over who gets what or who has power of attorney. Anyone can make a will and power of attorney through Legalzoom or prepaid legal. Also if one of you takes care of most of the money matters, you need to let your spouse know who to contact and where the money is located along with passwords for those accounts, and all the other information they may need. Check out how you can use lastpass to make that easier..

- Still having consumer debt – Come on now, it is high time you paid off those mistakes from your 20s. Debt can keep you from pursuing your long term goals, and can cause rifts in your marriage that you don’t want to have to deal with.

- Not funding retirement – It is closer than you think. Retirement needs to be planned for, some would say it is even more important than a childs education planning because there are scholarships for school, but not for retirement. Time and compound interest is still on your side but you need to start sooner rather than later.

What are some mistakes you think make your 30’s harder? Let us know below.

Other articles around this same topic…

image by flickrohit

Interest free loan

In light of Tax day here in the US. I wanted to point out as The National Center for Policy Analysis does. Your refund is nothing more than an interest free loan to the government. You over pay your taxes all year and get change early the following year. For some this is a windfall because they actually get all their money back and then some, meaning it is a way to cover up government handouts in tax language.

As the NCPA points out…

There’s some research to support tax refunds as a way of encouraging saving: Economists have found that people are more likely to spend $500 if it shows up as an extra $20 in every paycheck than if it arrives as one lump sum.

But, I assume if you are reading this you can probably do better than Uncle Sam with your money. Remember you can always get more money in your paycheck by reducing your withholdings according to the IRS’s own calculator.

Read the article here…

The Financial Moves You Should Make in April

Happy Financial Literacy Month! We go through the financial moves you should make every month, but April—being tax month and Financial Literacy Month—is a great time to start as any. Here’s what you should be doing in the next few weeks.

HT to: http://ift.tt/12ngjdS

Survivor Checklist with Lastpass

One big danger in the life of the person who takes care of the finances is death. Ok, sure we could all die, but if I died right now my wife would struggle to know how to access our insurance policies, bank accounts and other financial information. I run a lot of the day to day stuff in our home. While my wife is well informed of our current financial situation there are a lot of accounts out there. It would be a struggle for her to find them all. For years we have talked about a survivor checklist, but have never gotten around to creating a manual one, and I would never update it for each password. Then I thought about a tool I have used for years; Lastpass.

One big danger in the life of the person who takes care of the finances is death. Ok, sure we could all die, but if I died right now my wife would struggle to know how to access our insurance policies, bank accounts and other financial information. I run a lot of the day to day stuff in our home. While my wife is well informed of our current financial situation there are a lot of accounts out there. It would be a struggle for her to find them all. For years we have talked about a survivor checklist, but have never gotten around to creating a manual one, and I would never update it for each password. Then I thought about a tool I have used for years; Lastpass.

What is LastPass?

If you don’t know about Lastpass it is an amazing password management tool. It securely holds all of your internet account passwords and can autofill them for you. It also generates passwords for you, runs security scans and helps to keep your online account information safe. It can be used as a browser plugin or a phone application (premium service only) It also allows you to keep secure notes, a feature I never thought very much about until I was thinking about this survivor checklist. This is a way for me to communicate all of my passwords to my wife and help her remember all of the things that will need done. (hopefully someone else will be doing it for her).

I created a folder called “In the event of my death” with a note of the same name. It lists emails for our attorney and insurance agents so she won’t need to search. It also has a last goodbye and a few other personal items. These accounts are always up to date because they are what I use every day to access everything.

No one wants to think about death, especially their own. But, we will all die. If you are the person in your family who does most of the book keeping and money management and you don’t prepare something for your spouse to help them in the transition it will only make this time harder for them.

What to include in your Survivor Checklist

- Bank names, accounts and usernames and passwords

- Lawyer’s name and information for your will. (You do have a will, right?)

- Name and Number for Insurance agent for life insurance. (You do have insurance, right?)

- People to be notified of your passing with contact information.

- Any wishes not included in your will

- Perhaps, write your own obituary, that was really hard for us when my dad died.

- You may want to include something like this checklist from the Dennett, Craig and Pate funeral home.

- Copies of your social security, passport, birth certificate, all encrypted with Lastpass

Honestly, this is a lot of work. I would rather not do it, but I love my wife and want to make her life as easy as possible in the event of my passing. That thought helped me get through the process.

Resources:

Life hacker Master information kit.

Considering Stewardship is a site dedicated to managing your time, money, and talent in light of the Gospel.

Edited for broken link.

What’s good on paper is not always what is best for you.

Personal finance is a strange space. The people who are really into it are normally numbers people. They are really good at working out the numbers to find the one right way to do things. Every personal finance writer knows the right way to create a budget, the right amounts for an emergency account, and the right order to pay off your debt. The problem is all those things that look good on paper don’t work in real life nearly as well.

For example, there is a debate that rages among personal finance geeks over whether you should pay off your highest interest rate debt or your lowest balance debt first . The logic being that paying off the higher interest rate saves you interest in the long run, but paying off the lower balance builds emotional momentum. Most PF people including myself will argue for the mathematical advantage of paying off the higher interest rate. But, if you never get over that first hump and give up along the way it doesn’t matter if it is mathematically advantageous; doing it inefficiently is still better than not doing it at all.

. The logic being that paying off the higher interest rate saves you interest in the long run, but paying off the lower balance builds emotional momentum. Most PF people including myself will argue for the mathematical advantage of paying off the higher interest rate. But, if you never get over that first hump and give up along the way it doesn’t matter if it is mathematically advantageous; doing it inefficiently is still better than not doing it at all.

I think it is also best to give yourself a raise and reduce your tax return at the end of the year. After all I am sure you can use that money better than the government can. There is no reason to give them an interest free loan all year. Or is there? If you are the kind of person who may not use the extra money wisely and the only way you can save money is by forcing yourself to do it through your tax return, then it is the right thing for your; even if it isn’t mathematically (or politically) the best.

Personal finance is personal. Just because it is good on paper or in theory does not mean it is the best thing for you. As you begin your own personal finance journey don’t assume your life has to fit into the mold of anyone. Try what ever you need to do in order to be successful. That may mean throwing out the rules we personal finance geeks write. It may mean doing it your own way, and if you are successful you win.

Image by superfantastic

Things I learned from changing jobs

Changing Jobs

Almost a year ago I went through the process of changing jobs. In that change, I left a nationally known company where I had worked for eight years for a company I had never heard of until the recruiter called. The process I went through to decide if the new offer was better than my current job was pretty thorough. I am the kind of geek that created a spreadsheet comparing everything I could think of: salary, vacation plans, 401(k), bonus opportunities, commute times, holidays and a few other things. I tried to quantify things that were never meant to be quantified. I learned a few things about my self through that process.

I don’t trust God nearly as much as I thought I did.

I actually ended up having two job offers on the table at the same time. (Yes, I know, it is an embarrassment of riches) But, I don’t think I prayed about my new position as much as I should have. I felt that I could quantify everything and it would basically be a mathematical decision. Of course, it doesn’t work that way. But, I am really the kind of guy that doesn’t like to pray about the simple things. “Why bother God with things I can work out out on my own?”

I actually ended up having two job offers on the table at the same time. (Yes, I know, it is an embarrassment of riches) But, I don’t think I prayed about my new position as much as I should have. I felt that I could quantify everything and it would basically be a mathematical decision. Of course, it doesn’t work that way. But, I am really the kind of guy that doesn’t like to pray about the simple things. “Why bother God with things I can work out out on my own?”

I am still lead by my wallet far more than I want to be.

The fact that I made the decision by calculating the most minute details about money says a lot about how I view money in my life. The major deciding factor on if I took a new job was the money. Granted being a good steward of my skills means I should consider how much those skills are worth and find ways to use those skills to care for my family. But I don’t feel like I should be making decisions based predominately on my wallet, however, I still find security in my bank account and a steady paycheck.

There is Grace for it all

As many mistakes as I made along the way God’s grace is more than sufficient. That is the most important lesson.

All in all I am persuaded that I made the right decision. I am more satisfied with my new job than I was at my old job and I am making more money now. (Funny though, it still doesn’t feel like enough, even though I swore it would be; Ecc 5:10)

image by jakecaptive

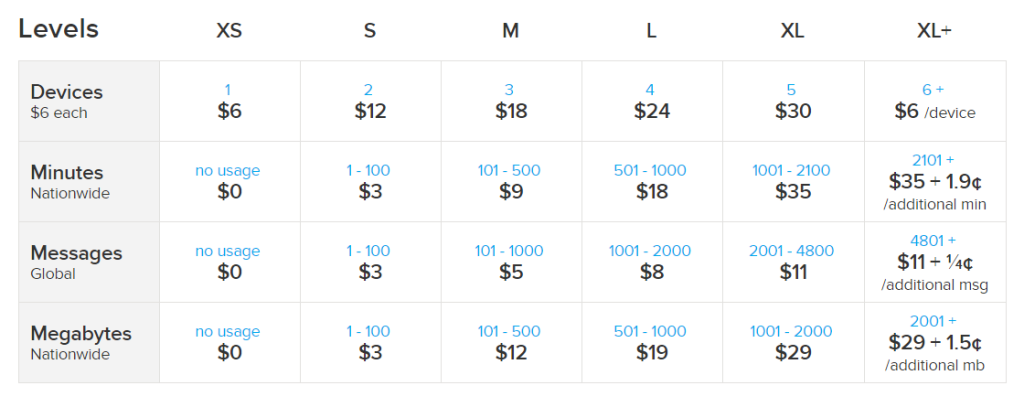

Making the switch to Ting

Why we chose Ting

Part of our new year budget project was to do some maintenance on some of our bills and see if we could save money anywhere. I have been with Sprint mobile for 15 years and have never had a problem, but with our contract expiring and not needing new phones I wanted to see if there were any other options.

I looked into a few different companies. The other big two, AT&T and Verizon, were more expensive than what we were paying at the time so I was able to rule them out right away. We had two main categories of options. I averaged out our actual usage with Sprint over the past year so I could compare how much we used our phones.

- Minutes

- 1200

- Texts (we were using google voice so all but 20 of our texts were free; we lost that ability and I had NO idea how many texts we sent)

- 20

- MB of data

- 2600

We compared and several different companies’ plans and Ting was our best option. First, because we didn’t have to pay full price for new phones to get started. Ting works on the Sprint network which means we could BYOD (Bring your own devices) Secondly, there is no contract required so we can test it out with no commitment. And finally because it would save us a bunch of money.

Ting is different

Ting ‘s billing is different from the traditional cell phone carrier. Instead of deciding on a plan up front and either over paying for usage you don’t actually use or under planning and paying overage fees; Ting has a flat set of rates. You pay for what you use. When we compared their rates to our usage (assuming XL for the texts I wasn’t sure about) for two lines we would be paying $96 which is $30 a month less than we were paying with Sprint (for the same cell network). This is a little strange to get used to after having more unlimited options. But it looks like we were over paying.

‘s billing is different from the traditional cell phone carrier. Instead of deciding on a plan up front and either over paying for usage you don’t actually use or under planning and paying overage fees; Ting has a flat set of rates. You pay for what you use. When we compared their rates to our usage (assuming XL for the texts I wasn’t sure about) for two lines we would be paying $96 which is $30 a month less than we were paying with Sprint (for the same cell network). This is a little strange to get used to after having more unlimited options. But it looks like we were over paying.

Although we are still in our first month things are going well. Tings app and website let you keep track of your usage and we are paying a little more attention to how we are using our phones. I am not using my navigation just for kicks anymore, for example.

We may switch it up if this doesn’t work or when our phones are ready to be replaced, republic wireless offers a better plan but $800 for two phones it would take almost two years for us to make back the initial investment in savings.

Head over to Ting and see how much you could save with their hand savings calculator, you may be glad you did.