Student debt can be dangerous

Heading off to college is a great adventure for many young people. I know it was for me so many years ago. It was my first time living on my own, 6 hours from my parents. I was very fortunate that my chosen school only cost a few thousand dollars a year for tuition. I was able to work full time and pay as I went. The only student debt I managed to accrue was because I was stupid with my credit card.

College is a strategic inflection point for many young people. It is a time when many don’t get good council about money. A degree can take you far, but it can also become an anchor around your neck. Here are a few things to think about when you are entering college.

Is student debt a good investment for me?

Everyone is supposed to go to college right? But if you think about your student debt as an investment you can determine if it is right for you. I can’t tell you how many young people I have worked with who didn’t need to go to college. They trained for years only to discover they didn’t like their chosen career. Now they have the student debt, but not the great job to go with it. We are told in the scripture how dangerous it is to pursue wealth (1 tim 6:6-10), but it is foolish to pursue and expensive degree without the ability to pay it back the student debt. Jesus told us to count the cost of following him and we should count the cost of our education decisions as well.

Everyone is supposed to go to college right? But if you think about your student debt as an investment you can determine if it is right for you. I can’t tell you how many young people I have worked with who didn’t need to go to college. They trained for years only to discover they didn’t like their chosen career. Now they have the student debt, but not the great job to go with it. We are told in the scripture how dangerous it is to pursue wealth (1 tim 6:6-10), but it is foolish to pursue and expensive degree without the ability to pay it back the student debt. Jesus told us to count the cost of following him and we should count the cost of our education decisions as well.

Many people consider their college years a right of passage, and to be sure many of us did our greatest growing and met our best friends and even our spouses (ring by spring of your money back) during these years. To be sure these years are very special, but that doesn’t mean you must pay a fortune to have these experiences. I don’t mind if people need time to “find themselves” and discover who they are, but it is foolishness to assume this must be done in a traditional college environment and can’t be done elsewhere.

Will my job pay for my degree?

A few years ago there was a push to get for-profit colleges to prove that students would be able to make money in the career of their chosen field. I don’t know why this isn’t a test for everyone. When you are signing up for student aid they have you work through a lot of financial worksheets. I don’t recall ever being asked if my chosen career path would provide enough money to pay back my loans. Maybe they don’t want you to ask that question. (I’ll be over here in my tinfoil hat)

I have talked with many recent grads. I ask them how they intend to pay off the student debt, which is larger than my mortgage, with a job that only pays $40k a year. This isn’t the barista job that they took because they couldn’t get employment in their field. This is the job in their chosen field. It is as if this thought has never occurred to them. Or worse yet, their thought is that someone else should pay it off because they are working in a “public” field.

One should not complain when what fulfills your heart doesn’t fulfill your wallet.

Is there another way to get this education or experience?

When I started looking into colleges to become a pastor my advisers tried to talk me into schools costing $40k a year. (in 1997) I decided to go a small bible college where I could learn by doing just as much as I would learn in the class room. I took an internship in the youth department and I read all I could get my hands on.

There are fields where you can get your hands on experience without going to a traditional university and in some cases maybe you should. After all once you have your first job or two on your resume no one cares where you went to school. (That is what hiring managers tell me in the tech field anyway)

Do you think I am full crap or do I have a good point? Let me know in comments below.

Image provided by donkeyhotey under the CC 2.0 license

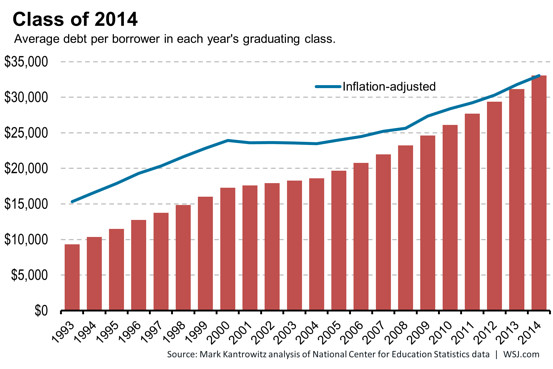

Congratulations to Class of 2014, Most Indebted Ever

The Wall Street Journal says “As college graduates in the Class of 2014 prepare to shift their tassels and accept their diplomas, they leave school with one discouraging distinction: They’re the most indebted class ever.”

I have often wondered if my choice to go back to school was a good one based on my situation. I was 32 and had no degree to speak of, but I was already deep into a career that required a degree. I was very fortunate to get into IT work during the boom when all you needed was a warm body and some aptitude. (which thanks to my parents getting me a C64 when I was 8, I had in spades) Did I really need to go back to school? Probably not, I took on some debt to do it although because of the program I was able to complete my degree in from 0-BA in two years. In working with a lot of college grads who are now turning to a bleak job market I have to wonder how much longer we will swallow the bitter pill of college.

There are some careers are always going to need a degree, but it seems like apprentice programs and boot camps would serve many people better in the log run. If you are going to take out a small mortgage for a career that pays $30,000 a year it isn’t a good investment or good stewardship of your money. I hope things turn around before my girls are old enough to face this ever growing mountain of debt.

HT to: http://ift.tt/UVpGPS

Is College Worth The Cost?

My church is full of college students. I have sat down and talked with many of them about how they are going to pay for their loans when they get out of school or now that they are out of school. It is sad how few of them understood what they were getting into when they signed on the dotted line.

In constant 2010 dollars the cost of a college education at a 4 year public institutions have increased 145% from 1990 to 2010. (http://nces.ed.gov/fastfacts/display.asp?id=76). That seems like a lot and since the jobs young people are promised when they graduate are not so easily found many people are questioning the decision that for so long has been a given.

Image from: http://www.finaid.org/savings/tuition-inflation.phtml

How does that compare to general inflation? Not very well if you are the one looking to fund an education. Inflation, the purchasing power of your money has been out paced by the increases in college costs.You can think of inflation as the amount the price of consumer goods increase on average. Either we can remember or our parents have told us stories of how things used to cost less. That is the effect of inflation. The price of consumer goods tends to increase for various reasons over time. However, this chart shows that the cost of college has increased much faster than general inflation, somewhere in the area of 150%-200% faster than general inflation, depending on the year. (http://www.finaid.org/savings/tuition-inflation.phtml)

Does all of this mean that college is no longer the deal that it once was? Not at all. The earning potential of the average college graduate is still much higher than that of the average high school graduate. According to G. Scott Thomas over at BizJournals:

Adults with bachelor’s degrees in the late 1970s earned 55 percent more than adults who had not advanced beyond high school. That gap grew to 75 percent by 1990 — and is now at 85 percent.

That alone could mean the difference around 1 million dollars over the course of a career, assuming one pursues a career that pays reasonably well in the first place.

For the question “Is college is worth the cost?” A fine arts degree may be your hearts desire but there is no guarantee it will pay the bills.

In my opinion the question is “Could I pursue my passion in another way?” Could you pursue an apprenticeship of some sort to learn what you need to know? With the rise of online learning could you learn what you need to pursue your career. I have heard from a few managers in my field that they don’t even pay attention to the education section of the resume in many cases because it matters more what you have actually done in the field.

Maybe you could start your own business or be self employed depending on what you want to do, you can certainly hire yourself without a degree.

Image from BusinessInsider

My fear in working with so many students struggling with college is that I really think we may be on the edge of some sort of education bubble. If you compare the increase in tuition to that of housing prices a few years ago it is staggering. The small bump that we saw in housing prices is noting compared to the skyrocket in costs of tuition. I don’t know that we will see degree foreclosures but I think something may be seriously wrong with they way we are doing higher education. Easy credit and government guarantees are helping more people take out loans but it is also making colleges more expensive as many are building resort style facilities to attract students who bring with them more government backed money. It is a spiral very similar to what we saw with housing I just hope it doesn’t crash as hard or many of us will be hurt in the process.

There are many variables in deciding if college, or what type is best for you and there are many ways to reduce your costs if you take your time and make wise decisions. But, we shouldn’t assume that a four year degree is right for everyone and it is fine if our children make different decisions as long as they are making wise ones. After all it is they who will have to work off that debt in the long run.

Here are some questions to consider:

- You loan payment will be approx $100 per month for every $10,000 that you borrow. Can you get a job to make that much with the degree you are pursuing? $100,000 in debt to be a youth pastor ($20k a year) not a good idea.

- Is there a different way I can pursue my passion without incurring large student loan debt?

- Is the traditional four year college even the right choice for me and what I want to do with my life.

- Do I want to work for someone else the rest of my life?

By the time my girls are reaching that age there are a lot more viable options for higher education than pushing everyone into the same college mold. But who knows what the future holds for education.

Cover image by TaxCredits