How a community can help your finances.

I have written before on my crazy ideas on how a community (a church specifically) can help one another financially, these are a little more down to earth. Being a good steward of your money goes against the flow of our materialistic consumption driven culture. It is hard to be the one who is looked at as cheap or broke, even if you aren’t. A solid group of like minded people can help support you in times of trouble.

- Like minded people are positive peer pressure. — I get asked at work at least once a week when I am buying a new PS4 or Xbox one. I hear the guys talking about the new games and I really want to regress to my bachelor days of spending the whole weekend in my room playing games. This isn’t the kind of peer pressure I need to be a good steward of my money, let alone my time.Just last week I wanted to go out to eat and asked one of the people that we were going to hang out with if they wanted to go. They said they had already spent their eating out budget, and so I felt influenced to save our money and eat at home before we all got back together to go hiking.A group of people that are all thinking the same way can help support you when you are feel like the only one not burying themselves in debt.

- You community can give you someone to do things with. — When everyone else wants to go out to eat and waste money on things you can gather your community to do a meal in together, or find an activity that doesn’t cost money.

Years ago our routine was to get together with two other couples and have a family style dinner and play board games. We saved money by eating together and had a blast creating memories and friendships.

- Your community can be your financial support.– As I have written before I think the church could do a better job of being the emergency fund for one another. Apart from that we can be a network for one another to help find jobs, get work or share the load when things happen.

It seems like every couple in our church is adopting right now and they are being supported, in part, by the community around them.

If you are going to be a good steward of your money, time and talent. It is very helpful to get a community around you to help. Let us know in the comments how you have been helped by you community.

5 Bible Verses about Money we don’t like to talk about

I recently read a similar post and it got me thinking about some of the Bible verses about money that we don’t like to talk about in the church. I suppose it depends on which end of the denominational spectrum you are from, but I selected a few that I think apply to everyone.

I recently read a similar post and it got me thinking about some of the Bible verses about money that we don’t like to talk about in the church. I suppose it depends on which end of the denominational spectrum you are from, but I selected a few that I think apply to everyone.

- Deut 14:22 –Those people who do talk about tithing take all their evidence from the Old Testament, and conveniently ignore this scripture that tells the believer to take their tithe and consume it is celebration of the Lord. If the temple is too far away the believer is instruction to sell their tithe take the money travel to the temple and “spend the money for whatever you desire—oxen or sheep or wine or strong drink, whatever your appetite craves. And you shall eat there before the LORD your God and rejoice, you and your household.” The tithe was meant to for the believer to celebrate the goodness of God, not just to be given to the temple.

I was taught that if I didn’t pay my tithe on time I owed an extra 20%. So, the idea of using to throw a party to celebrate the goodness of God would be blasphemy. But my wife and I have put this in to practice and invited people to celebrate God’s goodness in our lives.

2. Prov 21:13 — “Whoever closes his ear to the cry of the poor will himself call out and not be answered.” Social justice is becoming trendy and many folks want to use government to force people to do what they believe to be right. I don’t find it possible to love my brother by putting a gun to his head and forcing him “do the right thing”, but I do think about how I can help those who are less fortunate. Not in the short term, but long term. How can I help to break the cycle of poverty. It is one of the reasons I teach people about money.

3. Luke 6:20 — “Blessed are you poor, for yours is the kingdom of heaven . . . Woe to you rich, for you have received your consolation” Smithsonian magazine had an article earlier this year showing that 90% of Americans consider themselves middle class. Most of us don’t think we are poor. When we hear this scripture we think we are the blessed ones, but Americans are the rich Jesus is talking to. We are the 1% from the world’s perspective. We, as a church and individuals, must do more in order to help our brothers and sisters.

4. 1 Tim 6:8-9 — “But if we have food and clothing, with these we will be content. But those who desire to be rich fall into temptation, into a snare, into many senseless and harmful desires that plunge people into ruin and destruction.” We all assume we are not the one Paul is talking about. After all, I am not the one who pursues wealth, I just want to use money to promote God’s kingdom, of course I get to keep some too, that is beside the point. If we desire to be rich we will fall to many temptations don’t be fooled. This passage is directed at us all.

5. Luke 12:19-21 — “And I will say to my soul, “Soul, you have ample goods laid up for many years; relax, eat, drink, be merry.”’ But God said to him, ‘Fool! This night your soul is required of you, and the things you have prepared, whose will they be?’ So is the one who lays up treasure for himself and is not rich toward God.” This is the closest thing I have found in the Bible talking about the American idea of retirement. We want to sit back with our stored up treasure and eat drink and be merry. Rich toward God means more than giving him a small percentage off the top.

What other money scriptures don’t get enough recognition?

Make sure you don’t miss an article, subscribe to our newsletter.

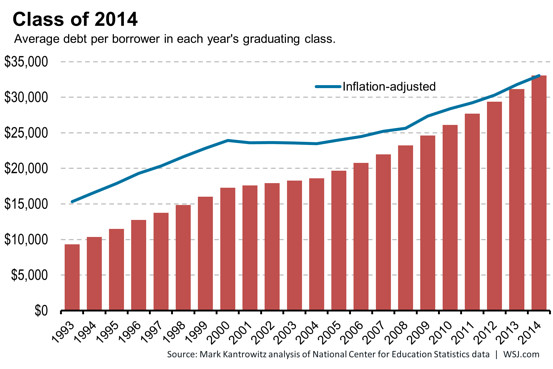

Congratulations to Class of 2014, Most Indebted Ever

The Wall Street Journal says “As college graduates in the Class of 2014 prepare to shift their tassels and accept their diplomas, they leave school with one discouraging distinction: They’re the most indebted class ever.”

I have often wondered if my choice to go back to school was a good one based on my situation. I was 32 and had no degree to speak of, but I was already deep into a career that required a degree. I was very fortunate to get into IT work during the boom when all you needed was a warm body and some aptitude. (which thanks to my parents getting me a C64 when I was 8, I had in spades) Did I really need to go back to school? Probably not, I took on some debt to do it although because of the program I was able to complete my degree in from 0-BA in two years. In working with a lot of college grads who are now turning to a bleak job market I have to wonder how much longer we will swallow the bitter pill of college.

There are some careers are always going to need a degree, but it seems like apprentice programs and boot camps would serve many people better in the log run. If you are going to take out a small mortgage for a career that pays $30,000 a year it isn’t a good investment or good stewardship of your money. I hope things turn around before my girls are old enough to face this ever growing mountain of debt.

HT to: http://ift.tt/UVpGPS

Have Millennials Been Robbed of Their Birthright?

The National Center for Policy Analysis has an interesting article out about the effects of our big government on our newest citizens.

Burdened with an obligation to pay government debt they did not incur, young Americans – those born between the early 1980s and the beginning of the 21st century, or millennials – begin life at least partially robbed of their birthright.

Is this an example of Robin Hood in reverse where the wealthiest generation is taking money from the poorest to support their own lifestyle? Maybe. The bible tell us that a wise man lays up an inheritance for his grandchildren. Not a debt. We are continually forcing our children to pay for things they did not ask for and do not want just to support politically powerful interest groups. That isn’t the biblical model of stewardship.

HT to: http://ift.tt/1IJadZO

When Does Saving Turn into Hoarding?

Over at Christianpf.com they had a good discussion on this topic with some good practical ideas on what to look at. I have a question as a thought experiment. Should Christians have a self imposed (I believe any sort of forced cap would be immoral) income or networth cap? I read about a church that did this for their leadership about 15 years ago. It felt like an over reaction to the prosperity “gospel” of the day and I wasn’t sure how I felt about it. But now I wonder if there is some wisdom in it.

We talk a lot here about how personal finance is personal and much of it deals with a position of the heart, but while we can talk about shades of gray eventually grey becomes black and I have been thinking a lot about where grey becomes black in the case of savings v. hoarding.

The Bible clearly states that saving is a good thing (see Proverbs 21:20) and that hoarding is not (see Luke 12:20-21). But is there a clear distinction between the two? And how can we know if we have crossed the line? There must be a line, but is it completely subjective or not? Should we think nationally where we may be in the bottom 10% or globally where if you are American you are in the top 1% no matter how poor you are?

I would love to have a constructive conversation about this because I process by talking things through. Does the Bible speak to this? I think John did in Luke 3 when he tells the people give one of their coats away if they have 2 and their neighbor has none. My family has more coats than we can fit in our closet! But so do most of our “poorer” neighbors.

So, what would this look like? I have no idea as I said it is a thought experiment and I would love to hear from anyone even if you think I am crazy. Drop a line in the comments below.

Christmas Spending Is a Test of Your Treasure

David Mathis over at Desiring God wrote a great article about how we regard money this time of year. It is worth the read just to challenge yourself on the idolatry of money. It is really hard to not spend money on things this time of year. But we are not called to spoil ourselves or our children. We are called to honor Christ. I do believe you can do that by giving gifts because that reflects the time when God gave the gift of himself but it is a fine line to not go overboard.

Not only are we on gift-expectation overload with Christmas, but then comes the year’s end and that one last chance for tax-deductible charitable giving. December bids us dig deeper in our wallets than any other season.

HT to: http://ift.tt/12OET8W

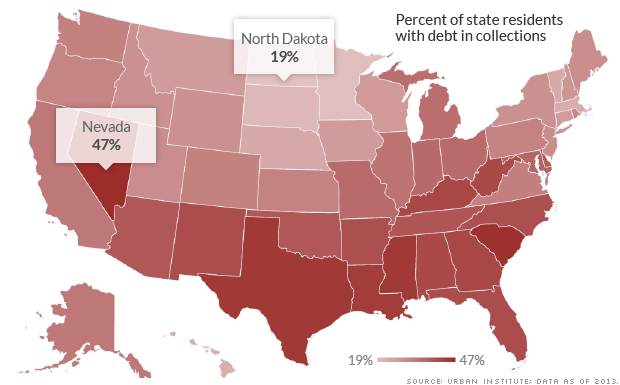

1 in 3 American adults have ‘debt in collections’

This is a pretty scary number. This is why being a good steward of your finances is so important.

Debt in collections by state

Americans have a debt problem. An estimated 1 in 3 adults with a credit history — or 77 million people — are so far behind on some of their debt payments that their account has been put “in collections.” That’s a key finding from a new Urban Institute study.

HT to: http://ift.tt/1nC2iSX

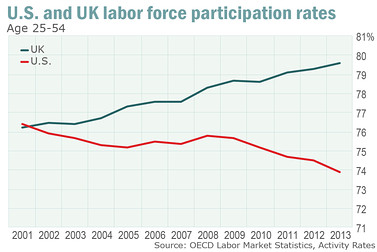

Tax Code War on Women

The real “w

ar on women” is in the U.S. tax code, says Diana Furchtgott-Roth, director of Economics21 at the Manhattan Institute. Single working women face higher tax rates when they marry, a reality that discourages marriage or encourages women who do marry to quit the workforce. When married women decide whether to enter the labor force, “their tax rate begins at the rate on the last dollar of income earned by their spouse,” Congressional Research Service specialist Jane Gravelle explained in a Senate Budget Committee hearing.

This article by Diana Furchtgott-Roth is an interesting read and is something young couples should consider when determining things like if and who will stay home with children. This appears to assume that Women are the secondary income earners in their family which may be mostly true but not always.

Currently, the U.S. tax code discourages work, discourages marriage and encourages women not to advance. This is the real problem for women that politicians should focus on.

Of course the tax code also discourages men from working in some cases, but the penalties of marriage do seem to practically hinder women more. The chart above compares US and UK women’s participation rates. The UK does not have the marriage penalties that the US does because couples still file separately and have their own deductions. All in all it was an interesting read for someone who is not a big “Women’s Studies” kind of guy.

HT to: http://ift.tt/1hoH2wI